As the heartbeat of the British economy, the housing market is highly sensitive to various factors, one of which is interest rates. Recently, the United Kingdom has experienced a series of interest rate hikes, leaving homeowners, potential buyers, and real estate professionals pondering the consequences. In this blog post, we delve into the effects of these interest rate increases on the local property market in East Molesey, Claygate, and Thames Ditton, three vibrant communities within the beautiful Elmbridge area.

Understanding Interest Rate Hikes: To grasp the implications of recent interest rate hikes, it is essential to comprehend why they occur. Interest rates are influenced by the monetary policy decisions made by the Bank of England (BoE) to control inflation and maintain economic stability. When the BoE raises interest rates, it becomes more expensive to borrow money, affecting mortgages, loans, and overall market dynamics.

The Impact on Local Property Prices: Interest rate hikes can have a direct impact on property prices in Elmbridge and its surrounding areas. As the cost of borrowing increases, potential buyers may face higher mortgage repayments, leading to a decrease in affordability. This could potentially slow down the demand for properties and, in turn, influence pricing levels. However, the impact may vary depending on factors such as local market conditions, supply and demand dynamics, and the overall desirability of the area.

Effects on Buyer Behavior: In a climate of rising interest rates, prospective buyers often reassess their purchasing decisions. Affordability concerns may cause some buyers to postpone or reconsider their property search, opting for more conservative choices. On the other hand, some individuals might perceive the rate hikes as a signal of a strengthening economy and view it as an opportune time to invest in property before prices potentially rise further.

Shifting Dynamics for Homeowners: Existing homeowners within the Elmbridge area may experience a change in their financial circumstances due to interest rate hikes. For those with variable-rate mortgages, the increase in rates will lead to higher monthly mortgage repayments. Consequently, homeowners might adopt a more cautious approach, focusing on budgeting and potentially reducing spending on other areas of their lives.

The Role of Supply and Demand: The local property market in East Molesey, Claygate, and Thames Ditton is driven by a delicate balance of supply and demand. Interest rate hikes can impact this equilibrium. If demand decreases due to higher borrowing costs, the number of potential buyers might decline. Conversely, a decrease in demand could motivate sellers to reevaluate their pricing strategies, leading to more competitive offers and potentially a more balanced market.

Conclusion:

The recent interest rate hikes in the UK have undoubtedly cast a ripple effect on the local property market in East Molesey, Claygate, and Thames Ditton. While there may be short-term adjustments in buyer behavior and property prices, it is essential to consider the broader economic context and long-term market stability. As trusted estate agents in Elmbridge, we remain dedicated to providing up-to-date insights and assisting our clients in navigating these changes effectively.

Remember, the impact of interest rate hikes on the local property market is a dynamic process, and monitoring the ongoing developments is crucial for both buyers and sellers. Stay informed, consult professionals, and make informed decisions to ensure your success in this evolving landscape.

Example by Maddie age 6, from Claygate.

Want to be in with a chance of winning a brand new Nintendo Switch? All that you have to do is draw us a picture of your dream home. Now this could be a home in outer space, this could be a medieval castle, this could even be a Minecraft house!

Once you’ve drawn your picture get your parent or guardian to like or follow us on Facebook or Instagram, and they can either take a picture of your picture and email it in to us, or alternatively they can drop it into one of our branches in East Molesey or Claygate.

Entries will be displayed on our screens in branch and 5 finalists will be posted to social media, the finalist with the most likes will be announced as the winner and will receive a brand new nintendo switch console!

RULES FOR ENTERING THIS COMPETITION ARE AS FOLLOWS:

- This competition is for children aged 11 and under.

- Entry is only available to local residents of; Claygate, Esher, Thames Ditton, Hinchley Wood, East Molesey and West Molesey. (Your postcode must start with KT8, KT7 or KT10 and winners will be asked to provide proof of address from their parent or guardian)

- The parent or guardian must like or follow our Newton Huxley Facebook or Instagram pages for your entry to be counted.

- Only entries received by the 16th March 2021 will be entered

- All entries will be displayed on screens at out offices so please make sure you put your name and age so we can add it to your picture.

- Entries can be made by either emailing to len@newtonhuxley.co.uk or dropped directly to our offices at either 15 The Parade, Claygate, Surrey, KT10 0PD or 33 Bridge Road, East Molesey, Surrey, KT8 9ER – dropping directly will alow us to scan your picture and will look best!

- Finalists will be selected and their pictures will be uploaded to Facebook and Instagram, the picture that receives the most collective likes by the 31st March will be announced the winner and invited to collect their Brand New Nintendo Switch from our offices.

We would prefer that you drop entries into one of our offices so that we can scan and upload the image clearly, but you can also submit you entry by email to len@newtonhuxley.co.uk

For many homeowners waiting for the right time to move, it has been a difficult decision to make for the past few years. The property market in the UK has been subject to an onslaught of market slowing events with what feels like endless elections, the EU referendum, changes to stamp duty land tax, and then this year to top it all off, the world was pretty much shut down by a coronavirus pandemic from COVID-19.

As soon as the property market was put on pause, the headlines wrote themselves, and the media reported that the property market apocalypse was approaching… but it never arrived.

Then, as the property market opened again, we were warned about how tough it was going to be to sell our properties, so was this prediction right?

Let’s take a look at what the data tells us…

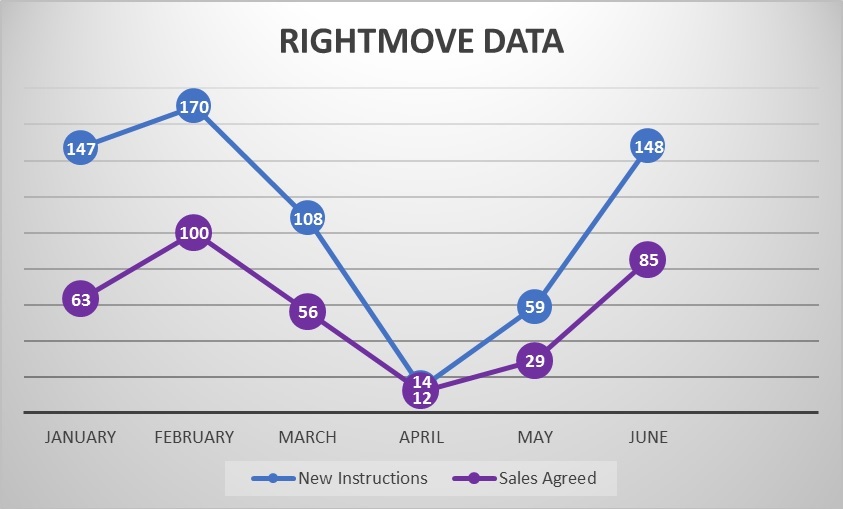

The below graph is taken from Rightmove data for the KT7, KT8 and KT10 postcodes which covers Thames Ditton, East and West Molesey, Hinchley Wood, Claygate and Esher (where Newton Huxley sell the most properties).

The local property market was showing very positive signs at the beginning of the year throughout January and into February, with the number of New Listings and Sales Agreed at healthy levels as you would expect to see. Then things began to turn in March as COVID-19 became the focus of everyone’s attention, and finally in April the market stopped almost entirely as viewings and mortgage applications were no longer possible.

In May, we can see the tide beginning to turn with urgent moves progressing and then in June we can finally begin to see what the property market looks like post lockdown… and so far it looks very good!

New property listings are quickly returning to pre-covid levels and as these properties attract the wave of new buyers from Central and South West London, we expect the number of sales agreed to catch up in July.

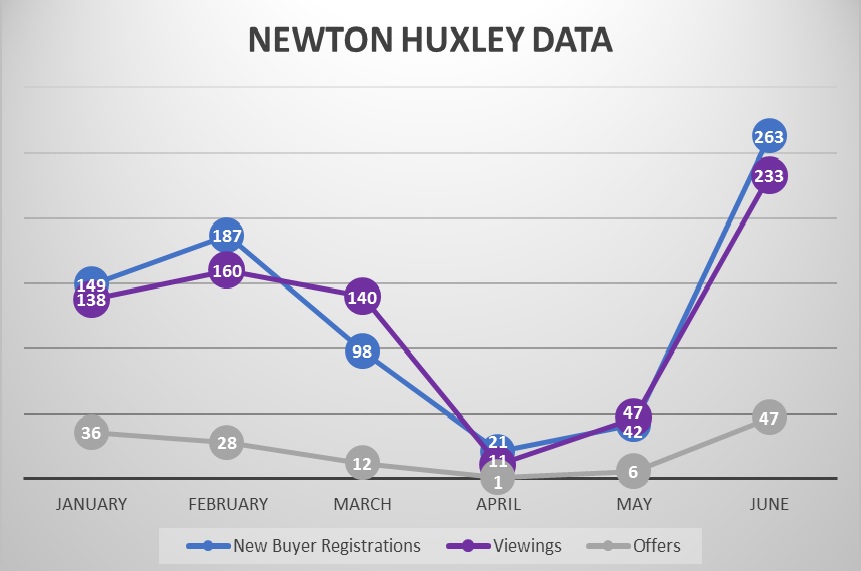

Our own internal data also shows positive signs for the local property market, with the number of offers received in June being at its highest level since October 2017.

This next graph shows the number of new buyers registering (people calling to ask us to help with their search for a property,) viewings booked, and the number of individual offers received on our listed properties.

Whilst it is too early to know for sure what the long-term impacts of COVID-19 will be on the property market, property transactions in the South East have been stunted since Stamp Duty Land Tax was changed in 2016 (by as much as 30% in our local area), and a bottleneck of buyers waiting for the right time to make their move has been building ever since.

Now interest rates are lower than ever before, and we’ve experienced a genuine public health issue that has had an impact on every single person one way or another. For many this has put things into perspective, and has served as a catalyst to further increase buyer migration out of Central and South West London, with some 51% of buyers that already live in the capital looking to move out.

With so many properties coming to market right now, and with lenders tightening criteria for mortgages, it is unlikely your property value will be shooting up any time soon. Many market reports are suggesting a 0% change in property values this year, and a modest 2% next year. So, if you have been waiting for the right time to move over the last few years like so many others in the KT7, KT8 and KT10 postcode areas, now is the closest you are going to get to the perfect time to finally get moving!

CLICK HERE To book a free valuation and market appraisal with one of the partner directors at Newton Huxley

You may be thinking of moving, or more likely, you are just interested to know if the value of your property has gone up or down. It can be really difficult to guage what is happening with property values, some estate agents are always talking up the market, and the media is generally extremely negative and apocalyptic about the housing market around Surrey and London.

Let us cut out the rhetoric and the "sales spiel" and get down to some undeniable cold hard facts!

Transaction Levels

For most of us, it feels like 2008 was only yesterday, the recession hit and transaction levels went through the floor. As an example, the KT10 postcode area (Esher, Claygate, Hinchley Wood) dropped from over 400 annual transactions to just 184. Since then transactions have increased until the most recent peak in 2013 of 446 total transactions. There has been a steady decline in the number of transactions since then, and in 2017 the Land Registry recorded 354 transactions across Esher, Claygate and Hinchley Wood. The level of transactions has declined by 21% since the most recent peak in 2013, but has increased by 4% over the last year. Hardly a disaster story and by contrast to 2008 levels, a very healthy market place indeed.

A similar story applies to areas like Molesey and Thames Ditton, with transaction levels down 21% over a similar period, and still way above 2008 levels.There really is no comparison to the 2008 recession that has been quoted by some of the more dramatic media sources. To sum up, we are not at the "height" of a market trend but we predict prices to remain where they are for the next 2-3 years with modest fluctuations of around 5% +/- throughout this period.

Property Values

So you know transaction levels are still high, just not as high as they’ve been before, and we know what we're all really interested in… The value of property!

Last year property values across Molesey, Esher, Claygate, Hinchley Wood and Thames Ditton slipped slightly, with the lower end of the market dipping around 5% and the £1m + market dipping by 7% or more. This was purely down to affordability issues and scepticism from would be buyers. As a company, we experienced a market where buyers wanted to buy with interest rates at an all-time low, but sellers were still hoping for record breaking prices creating a gap that either the seller, or the buyer needed to fill. As the consumer dictates the price of a product by demand, this quickly formed a "buyers’ market" mentality, but once asking prices were adjusted, there were plenty of buyers for every property as they jumped at the chance to secure a reasonably priced home.

Since the beginning of 2018, house values have increased across all of the areas we cover: KT10 by 5%, KT8 by 3.14% and KT7 by 5.43%, this shows that the adjustment in asking prices last year from the majority of sellers created more competition from buyers and therefore, persuaded buyers to part with (or borrow) more cash to purchase their next home.

What we are still seeing is an extremely price sensitive marketplace, overestimating your property's value or listing with an agent purely because they provided you with a surprisingly high and intoxicating valuation, can cost you in the long run. Where properties remain on the market for longer than expected, buyers will assume you are desperate to sell and we have in extreme cases, received offers 15% below asking price. This will hinder your chances of getting market value and will make it nearly impossible for your agent to negotiate the best possible price for your property. Correct asking price = hordes of buyers = multiple offers = best price AND best position to proceed.

If you are thinking of selling, look at the sold history in your area on either Rightmove, Zoopla or Land Registry, asking prices are not always, what a property will sell for. Check how long a property has been on the market for, ask yourself why it hasn't sold if it has been on the market for months. Get multiple valuations from agents who have a good record of accomplishment in your area, listen to the facts and evidence rather than just listening to what you hope to hear. In an age where "fake news" has penetrated the majority of information sources, only the facts and evidence that you can verify matter, and that is all a buyer will consider – unless they fall in love with your property and have to submit a sealed bid because there are multiple interested parties! They are more likely to consult their mortgage broker than sold data at that stage!

If you are thinking of selling, would like clear advice on the value of your home and the best marketing strategy to adopt when and if you decide to sell, please call our sales team on either 0208 396 6717 or 01372 631 622 for more information. Alternatively, you can book a FREE valuation by clicking the link below.

BOOK A VALUATION

With the support of Righmove.co.uk, the BEAG carried out analysis of some 1 million property listings, 3 million transactions, 50 million leads, 3 billion property views and conducted 30,000 mystery shops.

Only the top 20% of estate agents in the country have been featured in the guide, and not only are Newton Huxley the only estate agent in Molesey to feature in the Sales category, we have received exceptional status, placing us within the top 5% of estate agents in the UK.

So when it comes to choosing which estate agent should be appointed to sell your property, you can rest assured that you will get nothing but the very best from those featured in the Best Estate Agent Guide.

To find out more or to search the featured agents in your area please visit: www.bestestateagentguide.co.uk.

If you live in Molesey, Esher, Claygate, Thames Ditton or Hinchley Wood – you've already found your local exceptionally rated estate agent!

Call us now on 020 8396 6717 for more information about your local market or to arrange a free valuation of your home.

For those that live locally, you have hopefully noticed the increasing number of our "for sale" and "to let" boards going up over the last two years and more importantly, the high proportion that are being changed to "sold" and "let by". With a business model that focuses on proactivity in selling and letting property, by encouraging a "pick up the phone and sell" culture within our sales and lettings teams, we have experienced exponential growth in East and West Molesey, Claygate, Hinchley Wood, Esher and Walton On Thames, and are proud to report that our list of happy sellers and landlords keeps on growing!

Here is our latest video advert highlighting some of the statistics taken from the past year:

So What About 2017?

Many experts predict either a slow in growth or in some cases (particularly in South West & Central London), a drop in property values. Surrey has always been resilient in turbulent property markets and we fully expect this trend to continue.

As we focus on the South West London buyer that is looking to increase space in search of better value for money than what is offered by the London market, and looking to settle their family here and secure a place in one of Surrey's renowned primary and/or secondary schools, we have noticed that areas such as East Molesey, Hinchley Wood, Claygate, Walton On Thames, Hersham and Esher are still increasing in popularity thus creating a temporary boom within the local market, allowing sellers to hold firm on asking prices and achieve the result they are looking for.

There will inevitably be periods of uncertainty as we progress towards our exit from the EU. This will require some additonal proactivity from estate agents to secure fewer proceedable buyers, but we see no evidence of property values in the local area decreasing, however the chances of property values moving upward are very low.

This is still very good news for those looking to upsize and we would recommend that anyone looking to move this year do so sooner rather than later whilst activity and interest from buyers remains high.

If you are considering moving this year and would like an up to date valuation of your property, please call 0208 396 6717 or complete our valuation request form and a member of our team will contact you to arrange a free, no obligation appointment.

Here's to continued success and another fantastic year ahead!

You may have recently received a letter from us, offering a reduced commission rate in response to an influx of buyers and tenants registering for property in Surrey. More specifically, buyers and tenants migrating from South West London.

With demand remaining high, we have decided to extend our reduced commission promotional offer until the 12th December 20116

If you are considering selling or letting your property please contact our headquarters on 020 8396 6717 to speak to a member of our residential team.

ALL VALUATIONS ARE PROVIDED FREE OF CHARGE AND WITHOUT OBLIGATION.

BOOK A SALES OR LETTINGS VALUATION

We are constantly in need of additional stock to let to our register of tenants and we expect the new year to inspire many tenants to move home as per usual. Properties in; East and West Molesey, Esher, Thames Ditton, Walton On Thames, Hersham and Surbiton are of particular interest although all areas are eligible for the following offer.

We are offering to secure a tenant for your property within 2 weeks of marketing, and in the unlikely event that we are unable to do so we will reduce our letting fee by 50%.

Instructions to market your property must be received by the 14th January 2016. For more information, please feel free to contact me directly on 07885 206 at len@newtonhuxley.co.uk or via the office contact information above.

Terms and Conditions apply – available upon request.

Elevating the Elmbridge property market

Visit us in Molesey

East Molesey

Surrey

KT8 9ER

VISIT US IN ESHER

Claygate

Esher

Surrey

KT10 0PD