Buyers are out in full force with over 40 viewings completed this weekend alone. In particular we are seeing huge demand for properties with 3 and 4 bedrooms in KT8 and KT10 postcodes.

If you're looking to sell your property please do get in touch with us!

Thinking of selling soon? We'd love to help: BOOK A VALUATION

For many homeowners waiting for the right time to move, it has been a difficult decision to make for the past few years. The property market in the UK has been subject to an onslaught of market slowing events with what feels like endless elections, the EU referendum, changes to stamp duty land tax, and then this year to top it all off, the world was pretty much shut down by a coronavirus pandemic from COVID-19.

As soon as the property market was put on pause, the headlines wrote themselves, and the media reported that the property market apocalypse was approaching… but it never arrived.

Then, as the property market opened again, we were warned about how tough it was going to be to sell our properties, so was this prediction right?

Let’s take a look at what the data tells us…

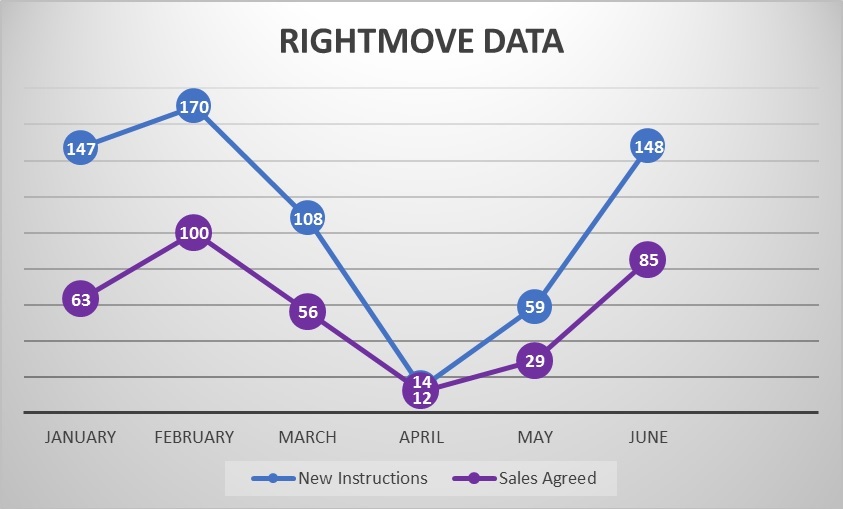

The below graph is taken from Rightmove data for the KT7, KT8 and KT10 postcodes which covers Thames Ditton, East and West Molesey, Hinchley Wood, Claygate and Esher (where Newton Huxley sell the most properties).

The local property market was showing very positive signs at the beginning of the year throughout January and into February, with the number of New Listings and Sales Agreed at healthy levels as you would expect to see. Then things began to turn in March as COVID-19 became the focus of everyone’s attention, and finally in April the market stopped almost entirely as viewings and mortgage applications were no longer possible.

In May, we can see the tide beginning to turn with urgent moves progressing and then in June we can finally begin to see what the property market looks like post lockdown… and so far it looks very good!

New property listings are quickly returning to pre-covid levels and as these properties attract the wave of new buyers from Central and South West London, we expect the number of sales agreed to catch up in July.

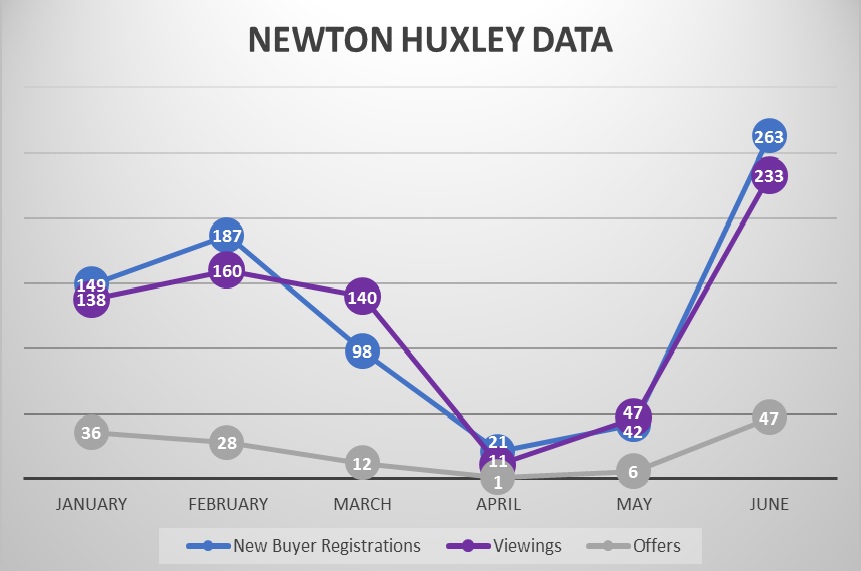

Our own internal data also shows positive signs for the local property market, with the number of offers received in June being at its highest level since October 2017.

This next graph shows the number of new buyers registering (people calling to ask us to help with their search for a property,) viewings booked, and the number of individual offers received on our listed properties.

Whilst it is too early to know for sure what the long-term impacts of COVID-19 will be on the property market, property transactions in the South East have been stunted since Stamp Duty Land Tax was changed in 2016 (by as much as 30% in our local area), and a bottleneck of buyers waiting for the right time to make their move has been building ever since.

Now interest rates are lower than ever before, and we’ve experienced a genuine public health issue that has had an impact on every single person one way or another. For many this has put things into perspective, and has served as a catalyst to further increase buyer migration out of Central and South West London, with some 51% of buyers that already live in the capital looking to move out.

With so many properties coming to market right now, and with lenders tightening criteria for mortgages, it is unlikely your property value will be shooting up any time soon. Many market reports are suggesting a 0% change in property values this year, and a modest 2% next year. So, if you have been waiting for the right time to move over the last few years like so many others in the KT7, KT8 and KT10 postcode areas, now is the closest you are going to get to the perfect time to finally get moving!

CLICK HERE To book a free valuation and market appraisal with one of the partner directors at Newton Huxley

Since the government re-opened the property market in April, buyers and tenants have been queuing up to view properties at a rate we have never experienced before. Now is a brilliant time to move with low interest rates and plenty of choice out there, but we still need to do it safely and responsibly to make sure we do not put ourselves or others at risk.

Here are 10 things you need to know about viewing properties safely:

- Initial viewings should be done virtually wherever this is possible and property agents should help you to do this: Our team have been busy preparing video walk throughs on all of our properties wherever possible, this is also a great way to ensure you do not waste your time viewing properties that aren’t suited to your needs.

- All physical viewings should be limited to members of the same household and open house viewings should not take place: Hopefully this is an obvious one! If an agent invites you to an open house, you will find it nearly impossible to maintain a safe social distance so you should be viewing on your own with the agent or homeowner, and ideally for a maximum of 15 minutes per viewing.

- When physically viewing properties, where possible, you should avoid touching surfaces, wash your hands regularly, and bring your own hand sanitiser. The number of people on a viewing should be minimised to those from your household that absolutely have to be there. If you need to be accompanied by small children, you should try to keep them from touching surfaces and ensure they wash their hands regularly.

- Clean surfaces and open all doors: If people are being shown around your current home, you should open all internal doors and ensure surfaces, such as door handles, are cleaned after each viewing with standard household cleaning products. You should also try to open windows to air out the property at least 30 minutes before the viewing takes place.

- Vacate for viewings: We recommend this anyway to allow potential buyers or tenants to view and provide honest feedback without the risk of offending the current owner/occupier. At present we recommend that you vacate your property whilst viewings are taking place in order to minimise your contact with those not in your household.

- Anyone involved in any aspect of the home moving process should practice social distancing in line with public health advice. This includes; viewers, surveyors, agents, removals, cleaners, inventory clerks, contractors and anyone else that wants to have access to your home!

- When moving between properties, you and those in your household should try to do as much of the packing yourself as you can. Where this is not possible, you should speak to removal firms in advance.

- If you are particularly worried about the risk of infection, then speak to the professionals involved: your landlord, estate agent or removers may be able to put in place extra measures to accommodate your needs.

We are proud to announce that we have started 2020 the best way we could have imagined, with the acquisition of one of the longest standing and locally renowned businesses in Claygate Village. The team at Catling & Co, along with an extensive portfolio of managed rental properties is a welcomed addition to our business, and we look forward to building upon their local reputation and the service they have provided to the Claygate community over the last 25 years.

Although we will be converting the high street office at 15 The Parade, Claygate, KT10 0PD into a Newton Huxley branch at the begining of February 2020, the Catling team will remain in this branch and we welcome their continued support in maintaining the proactive, professional and approachable reputation that Newton Huxley has built since our launch in 2015.

John Catling, who will remain as a consultant for a period of time during the transition has released an open letter to clients past and present:

As Catling & Company enters its 26th year of trading, it is with a heavy heart that I have finally made the decision to spend more time with my family and retire.

I have taken careful consideration to ensure that my loyal clients remain in good hands, and at the end of 2019 I officially handed over the reins to Len Taylor & Sam Kamali at Newton Huxley, who are another local, bespoke agency just like Catling & Co. I have no doubt in my mind that Newton Huxley, together with my team at Catling can at the very least maintain the standards we have upheld over the last 25 years, and will work to improve upon them.

Sarah Wren and the rest of the existing Catling & Company team will remain indefinetely, I will also be retained as a consultant to assist with the transition for a period of time.

I would like to thank you for your continued loyalty and custom and very much look forward to the next chapter.

One of the Managing Directors at Newton Huxley, and local Claygate resident Len Taylor had this to say about the recent aqcuisition of Catling & Co:

We are delighted and feel priveleged to have been given this opportunity to work for the clients that John and his team have taken such good care of over the years.

As a Claygate resident myself I feel very fortunate that we have such an active community and have experienced first hand the positive impact this has on local residents, and I hope we will be able to contribute for many years to come.

As estate agents we also know that this is part of what makes the area a number one choice for young families moving from South West London which is why we opened here in the first place. I hope that we can rely upon the support of the local Claygate community, and in return we will continue to provide a reliable, trustworthy service that we are immensely proud of.

The team at Newton Huxley are already experiencing increased interest in our available properties both for sale and to let for January. 2020 is widely anticipated to be a positive year for the housing market, and we invite you to pop into the newly refurbished branch from 1st February should you wish to discuss the local market or any property plans you may have.

House prices increased by an average 33.7% in the last decade and despite being relatively flat over the last couple of years, due to the uncertainties surrounding Brexit, are set to rise by a further 15.3%, according to latest predictions, in the next 5 years. However, there are likely to be significant regional differences with properties in the North of England expected to see the strongest price growth of 24% between 2020 and 2024. Central London properties are also set for a rebound with predictions of 20% growth and only 5% growth in Greater London.

According to Rightmove, the property market will increase by 2% in 2020. But that a lack of supply, with demand remaining high, could push prices higher. Added to which, low interest rates, lenders competing to lend, high unemployment and a continued growth in wages, helps buyer affordability.

So, if you are planning on buying or renting a property in 2020, how will this impact you?

- House prices are forecast to grow by 2% in 2020, but stocks are expected to remain low. So, if you are thinking of buying, now is the time to get your property on the market, so that you're ready to move when the right property comes along. If you're renting, the number of letting properties are likely to remain low, which could prompt an increase in prices.

- First-time buyers. Schemes such as The Lifetime ISA, will help people raise the deposit required to buy a property. Which typically can be up to 20%. The good news is that interest rates are expected to remain low, which will make mortgages more affordable.

- Brexit. After the UK leaves the European Union on January the 31st, there will be some uncertainty surrounding the housing market. Currently confidence levels are high, so the 'Boris effect' may help property prices remain buoyant. A weak pound however, could encourage more overseas investors entering the market as this makes UK property relatively inexpensive.

Think you need to avoid selling your property over Christmas? Think again. Potential buyers have more time over Christmas and, according to Rightmove, the Christmas period and particularly Boxing Day, is one of the busiest of the year, with people searching for a new home.

So, what do you need to do to maximise a potential sale over Christmas?

- Make sure your property is visible online and listed with all the major property portals.

- Winter viewings. There's something quite special about a property dressed with Christmas decorations. Stepping into a warm house, with the light of a fire and twinkling lights can show off a property at its best. Helping prospective buyers visualise living there.

- Serious buyers. People house hunting over Christmas are more likely to want to complete early in the New Year. You'll get a greater proportion of motivated buyers, looking to agree a sale.

- Plan ahead. Don't leave putting your property on the market too close to Christmas. Whilst your home will look attractive with Christmas decorations, you want to ensure the photos of your property are taken before the decorations are put up.

- Ready for the New Year. Once Christmas is out of the way, there is a traditional New Year rush, as families make the decision to move over the Christmas period. Getting your property listed before Christmas ensure you are ready to make the best of this busy time of year.

If you need advice about selling over Christmas, contact us today.

According to the Federation of Master Builders (FMB) and the Home Owners Alliance (HOA), you can enhance the value of your property by almost £50,000 simply by removing an internal wall to create an open plan kitchen and dining area.

Chief executive of the FMB, Brian Berry, said the work would cost less than £3,500, take seven days to carry out, and would add £48,417 to an averagely priced home in London.

"By investing in low-cost, high-return projects, not only will you make your home a more pleasant place to live, you’ll also be increasing its value significantly. Better still, these projects take no time at all so the hassle factor will be kept to an absolute minimum," he said.

But what if this isn't an option? What other projects could you invest in to significantly add value in a short amount of time? Here are some options:

- Build a garden room or outside playroom. Typical costs for this project will be in the region of £6,500, but will add an average (in Surrey) of over £35,000. A massive £28.5k profit.

- Update your kitchen. With careful planning this could cost in the region of £4,000, but could add almost £27,000 to the value of your property.

- Turn a cupboard into a downstairs toilet. With an initial outlay of just over £2,500 it could add up to £24,000 to the value of your property

- Add an en-suite bathroom. Converting part of a bedroom into a a bathroom can cost as little as £4,700, but add in excess of £14,500 to the value of your home.

- Add a driveway. If you have the space, buyers will pay more for a property with added parking space. For an investment of £2,200 you could add £13,300 to the value of your property.

- Install decking. For just under £4,000 you could add decking and lighting generating additional value of up to £9,000.

Potential returns will vary by property and location. Contact us if you'd like specific advise, before you invest the money.

Did you know that when you rent out all or part of your home a Capital Gains Tax (CGT) charge may apply when you sell the property? Currently, HMRC exclude the last 18 months of your ownership – even if the property is let for this time – when assessing any CGT liability. However, in a draft of the Finance Bill released earlier this year, HMRC have confirmed that this 18-month period will be reduced to 9 months from April 2020. Disabled property owners, or those in a care home, will continue to be exempt for 36 months.

The Finance Bill also outlines a change to the letting relief rules…

Letting relief is an extra deduction you can make from any CGT payable when letting your home. Under the rules, you can claim the lowest of the following three amounts:

- The same amount that you can claim as private residence relief.

- £40,000.

- The same amount as the chargeable gain you made from letting your home.

From April 2020, you will only be able to claim this letting relief if you are in shared occupancy with the tenant.

Property owners that are considering the sale of their home – which is or has been let for any period – may be advised to complete their sale before April 2020. In this way they will benefit from the 18 month exemption and the more flexible lettings relief.

If you're thinking about buying a new home, you'll need to budget for more than just the deposit. It's a stressful time, saving! You work hard to put away savings each month and feel like celebrating when you have saved enough for that all important deposit. But don't get carried away too early, as there are other costs that you need to take into account!

When you're working out your 'buying a house' budget, you also need to take account of the cost of buying, your mortgage fees and moving costs – on top of your deposit. It all adds up and can easily plunge you into debt if an unexpected bill hasn't been taken into account.

Here's what you need to know about and budget for:

- Mortgage fees. On top of your deposit you need to take account of the charges that your mortgage provider will require as part of the application process. These can vary from a few hundred pounds to several thousand pounds. Shop around to get the best possible deal. Also bear in mind that an electronic transfer fee is often applicable when the mortgage is paid out. This is often in the region of £50.

- Surveyors fees. You may view this as a necessary evil in order to comply with your mortgage, but having a professional survey could save you thousands in the longer run. A basic survey could be as little as £250 to £300, but really amounts to little more than a valuation. Paying extra for a homebuyers report, or even a full structural survey, could identify issues that enables you to renegotiate the price or save you money and headaches in the longer term.

- Legal fees. You will need a solicitor to carry out the legal searches on your property; to identify if a new motorway is likely to be built alongside your new property, for example. Fees for these are typically less than £250. Whilst the paperwork for the purchase of your property could cost £1000 to £1500.

- Stamp duty. Depending upon the purchase price of your property you will need to pay stamp duty to the Government. If you are a first time buyer you won't pay stamp duty on the first £300,000. Whilst you are only exempt from paying stamp duty on the first £125,000 if you are not a first time buyer.

Rate

Charge Band

0%

Up to £125,000

First-time buyers: first £300,000 for property up to £500,000

2%

Over £125,000 to £250,000

5%

Over £250,000 to £925,000

10%

Over £925,000 to £1,500,000

12%

Over £1,500,000

- Estate Agent fees. You only pay estate agent fees of you are selling a property. So if you are a first time buyer, you shouldn't need to budget for Estate Agent fees. If you are selling, the fees are typically one to three per cent of the final sales price. With VAT usually chargeable on top of that.

- Moving costs. Unless you are prepared to rent a van and move yourself, you will need to budget for a professional removal company to move your possessions. Fees are typically £400 to £600.

- Decorations and refurbishment costs. It's worth being clear exactly what is included within the sale. If you need to buy carpets, curtains, curtain rails and more, these can quickly eat into your budget. Even a fresh lick of paint can add up. And that's before any more extensive refurbishments that may be required. Where possible get quotes up front, so you know what costs will be applicable after you've purchased the property.

- Rates. And finally, make sure you know what rates are payable (to your Local Authority) for the property that you are purchasing. As this can often be another overlooked cost.

Elevating the Elmbridge property market

Visit us in Molesey

East Molesey

Surrey

KT8 9ER

VISIT US IN ESHER

Claygate

Esher

Surrey

KT10 0PD